Hello friend Here we are telling you all information regarding UPI,this is a new system of payment and for other bank transaction.But some different from NEFT,IMPS.UPI stands for Unified Payment Interface which is introduced in order to facilitate faster and more reliable transaction.With UPI you do not have to worry about giving Account Name, Bank Account Number, Branch or IFSC Code to the sender or you do not have to take the same if you are sender. All you need is an alias means an ID which looks very similar to Email address.

Example for UPI ID:username@bankname

What is Unified Payment Interface & How it Works:-

UPI is introduced by NPCI (National Payment Corporation of India) which deals with fund transfer and Raghuram Rajan (Gov, RBI); and they introduced it in order to make fast, secure and more reliable way of sending money from one bank account to other immediately.

basically all you need is a small UPI code to send or receive money from someone or soon you will be able to use it for online shopping or any online transaction as everyone implements it in there payment system.

How to Create UPI ID (Virtual Address):-

IMPS vs UPI:-

basically all you need is a small UPI code to send or receive money from someone or soon you will be able to use it for online shopping or any online transaction as everyone implements it in there payment system.

Benefits of using UPI (Unified Payment Interface):-

- Now INSTANTLY Send or Receive Money from one Bank to other .

- No need to remember Account Number, IFSC Code.

- You have to choose your own unique UPI ID Code.

- You can create any number of UPI alias.

- You can send or receive money anytime you want (24 x 7).

UPI App Free Download for All Banks:-

| Bank with UPI | UPI App Free Download |

|---|---|

| UPI ICICI App | Click Here |

| PNB UPI | Click Here |

| SBI UPI App | Click Here |

| HDFC UPI App | Click Here |

| Andhra Bank | Click Here |

| Axis Bank | Click Here |

| Bank of Maharashtra | Click Here |

| Bhartiya Mahila Bank | Click Here |

| Union Bank of India | Click Here |

| YES Bank | Click Here |

list of Banks providing UPI support enabled mobile application are Andhra Bank, Axis Bank, Bank of Maharashtra, Bhartiya Mahila Bank, Canara Bank, Catholic Syrian Bank, DCB Bank, Federal Bank, ICICI Bank, TJSB Sahakari Bank, Oriental Bank of Commerce, Karnataka Bank, UCO Bank, Union Bank of India, United Bank of India, PNB, South Indian Bank, Vijaya Bank and YES Bank.

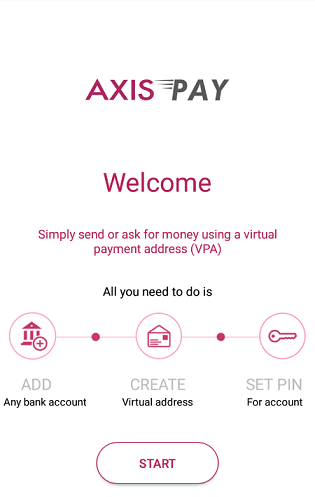

How to Create UPI ID (Virtual Address):-

- Download UPI based app from above table for your bank.

- Open your Internet banking account or Add your bank account.

- Now create Virtual Payment Address or UPI ID. [Ex.: yourname@axis OR example@pockets]

- Now finally set a PIN for your account.

How to Send Money using UPI ID?

- Login to Pockets app and tap on 'UPI'.

- Click on 'Send Money' using VPA (UPI).

- Fill in details, amount and remarks. If you have multiple accounts / virtual payment addresses, choose the VPA you would like to debit.

- Check the details and click on 'Confirm' to initiate your Fund Transfer.

How to Receive Money through UPI Virtual Address?:-

When someone send request for payment, you will get notification in your phone.- Alternatively, login to your Bank UPI App and click on the UPI section.

- Then simple choose 'Respond to Collect Money'.

- Choose the VPA from which the payment needs to be made.

- Your account will be debited when you click on 'Confirm' for same Bank.

- If you have chosen another bank account, you will be asked to enter your UPI PIN of the bank account.

- After verification, funds will be transferred instantly to the beneficiary.

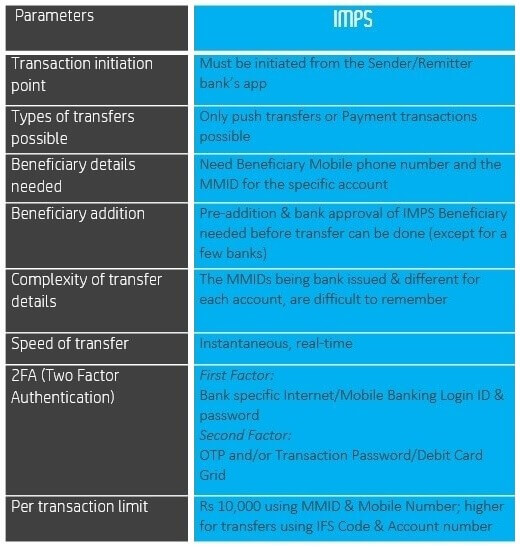

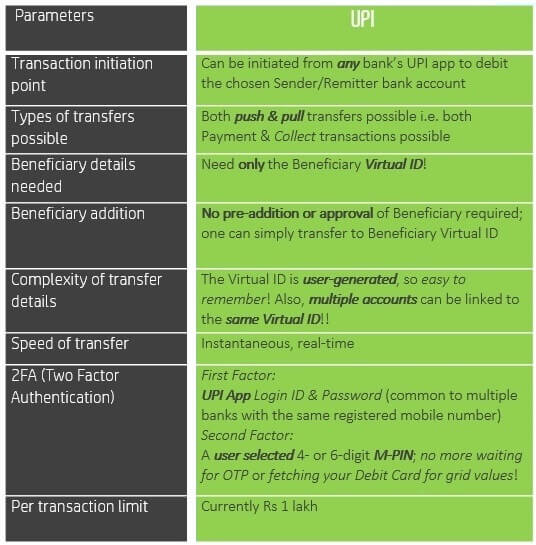

IMPS vs UPI:-

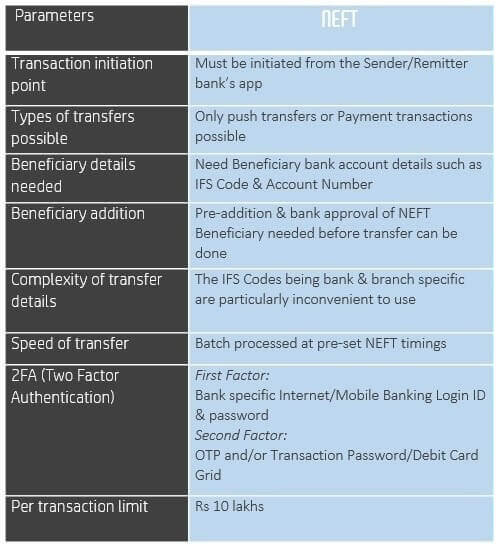

NEFT vs IMPS vs UPI

What is UPI:-

Key Points about UPI Payment Mode:- Per Transaction Limit: 1 Lakh Rupees.

- Send / Receive Money from Any Bank to Any Bank.

- Need only one simple Virtual UPI ID for transaction.

- Instant Transaction.

Way cool! Some extremely valid points! I appreciate you penning this post and the rest of the website is

ReplyDeletereally good.